The Business Goal

A mortgage industry startup needed a clear, user-friendly way to keep homebuyers informed throughout the complex loan process. Inspired by the simplicity of a pizza tracker, they envisioned a similar experience that would set them apart in the market. The company also wanted to streamline internal operations for their processing team (“the factory”) by making it easier to track a loan’s current stage and ownership.

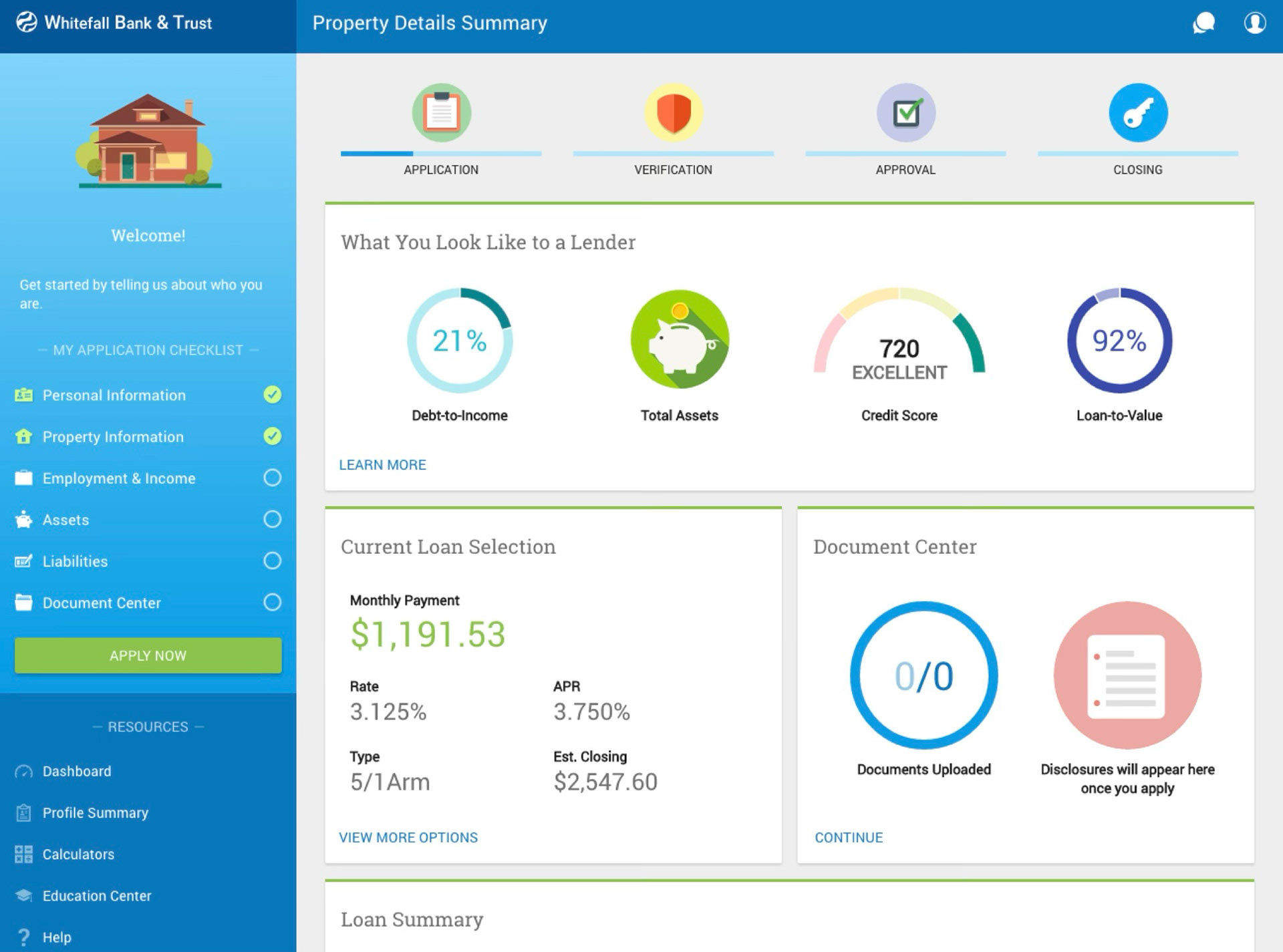

The first iteration of the pizza tracker.

The Challenge

Unlike a food delivery timeline, the mortgage process isn’t linear. Loans often move backward when new information emerges or stall when documentation is missing. A rigid, step-by-step tracker didn’t reflect this complexity and risked confusing users.

There was another constraint: the “pizza tracker” metaphor was already positioned as a key differentiator for investors. This meant the solution needed to stay within the tracker framework—while still reflecting the realities of the mortgage lifecycle.

The customer facing side of the new tracking service

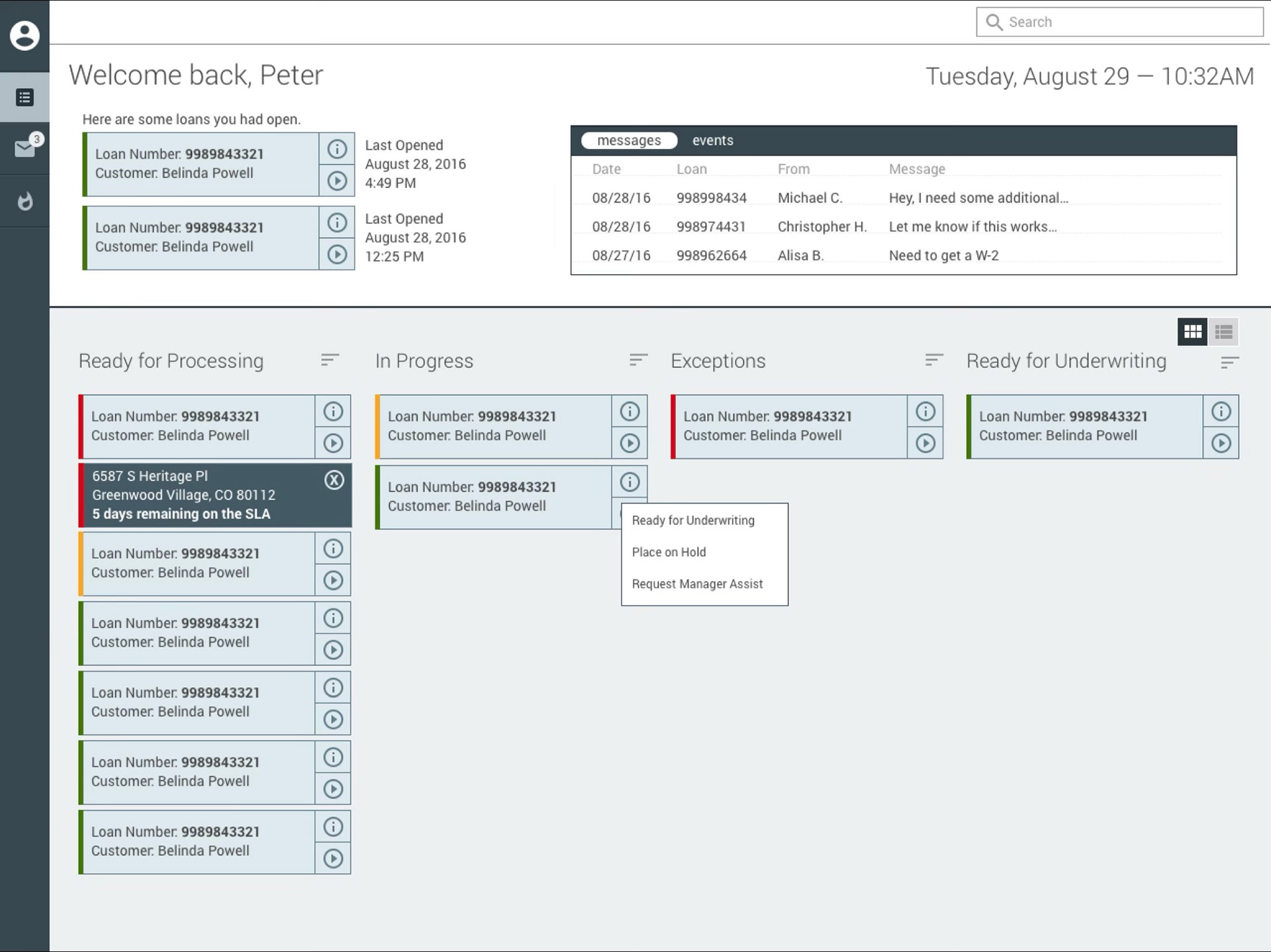

A wireframe of the factory facing side of the new tracking service

The Strategic Design Response

To align the vision with operational realities, we reimagined the tracker to focus on progress within four core phases: Application, Verification, Approval, and Closing.

Each phase could visually expand or contract based on how complete it was, giving customers a clearer view of their actual status. This model allowed room for backward movement or paused states—without disrupting the overall sense of progress.

Internally, this modular approach gave the processing team more control. They could tag loans by phase, see where handoffs were happening, and communicate directly with borrowers when additional documentation was needed.

Outcome & Impact

The revised design was presented during an investor all-hands meeting. It preserved the promise of a “pizza tracker” while delivering a solution that worked for both users and internal staff. The response was overwhelmingly positive, securing a new round of funding for the company to move forward with product development.